Extra Mortgage Repayments: How Much Can You Really Save?

There’s an old legend about the origin of chess. When the game’s inventor presented it to the Emperor of India, the Emperor was so impressed that he offered the inventor any reward he desired.

The inventor made a simple request: “Place one grain of rice on the first square of a chessboard, then double it for each subsequent square. So, two grains on the second square, four on the third, and so on.”

The Emperor, amused by the modesty of the request, quickly agreed. But as the grains were doubled with each square, the emperor soon realised that by the time they reached the 64th square, he would need more than 18 quintillion grains of rice—an impossible amount.

This story is a great illustration of the power of compounding—and it’s the same principle that can help you save thousands on your mortgage.

Why Extra Mortgage Repayments Are So Powerful

When you think of making extra mortgage payments, you might think of it in terms of $100 now to save $100 later. But in reality, the benefits are far greater.

Every extra dollar you pay reduces the principal—the amount on which the lender charges interest. This means that each additional payment doesn’t just save you the amount you put in—it reduces the interest charged on the entire remaining loan.

The more you reduce the principal, the more interest you save in the long run, creating a snowball effect. It’s similar to the fable of the chessboard—small contributions now lead to exponential savings down the line.

The Impact of Extra Repayments

Consider this example:

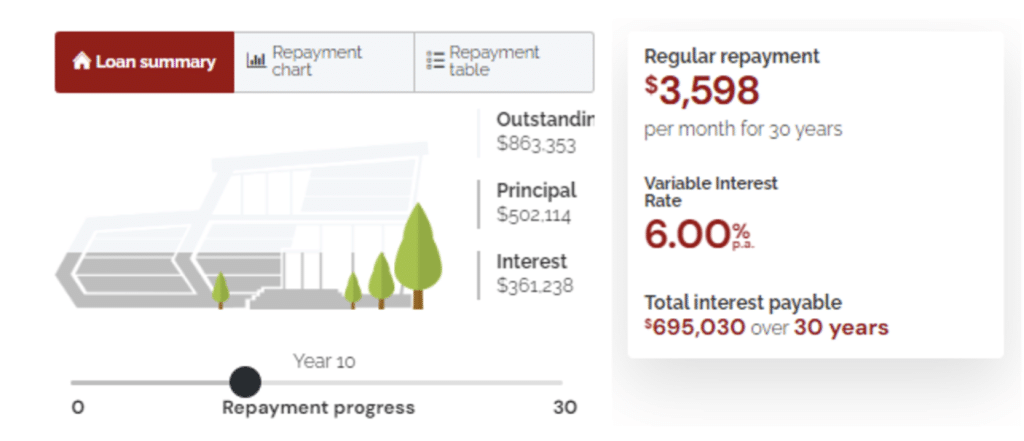

A loan of $600,000, with an interest rate of 6% (for ease let’s pretend the rate doesn’t change), has a monthly repayment of $3,598 (assume no fees).

Over 10 years that’s $431,760 in repayments.

The bad news? Only $97,886 was actually paid off your loan!

$333,791 went just into covering the loan interest,

That’s 77% of your repayment over the first 10 years!

So, how do you get back control?

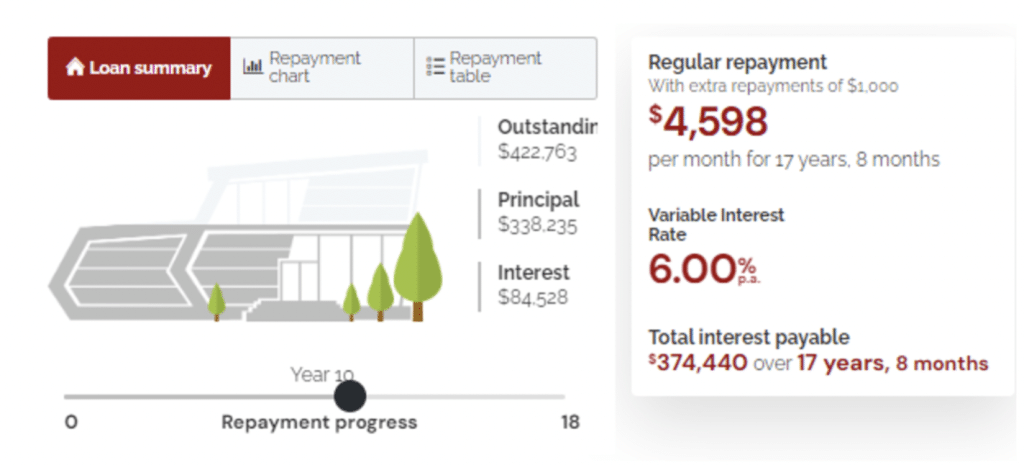

If you were to make an additional $1,000 per month, over that same 10-year period, you would have only paid $84,528 in interest.

That’s 19.58% of the original $3,598 going towards interest and 80.42%, or $347,232, going towards principal.

Big difference.

If you were to continue to make the additional $1,000 per month payment, the total savings would be $320,590 and 12 years and 4 months in time.

You can run the numbers yourself using our Extra Repayment Calculator.

Just like the grains of rice, small extra payments can add up to big savings over time.

Start Small, Save Big

You don’t need to make huge extra repayments to see results. Even small contributions add up over time. Consider increasing your repayments by $50 or $100 a month—this can quickly lead to significant savings. The earlier you start, the more dramatic the impact on your mortgage will be.

The Takeaway: Think Exponentially

Small actions, repeated consistently, can lead to massive results.

Extra mortgage repayments don’t just save you the amount you contribute—they exponentially reduce the interest you’ll pay over the life of the loan.

So, don’t think of extra repayments as a one-to-one trade-off. Think of them as an exponential investment in your financial future. Start small, and watch your savings multiply.

Are you ready to see the power of extra repayments in action?