Advice for First Home Buyers In Geelong

& The Bellarine Peninsula Who Want to Know…

Firstly, which one do you choose? Which of their products is right for you? And what about other lenders, building societies and credit unions?

Australia is indeed the lucky country. We are blessed for choice when it comes to the amount of competition that exists when it comes to the mortgage market. With so many lenders, and so many products under each of their brands, it’s important you make the most of this regarding who and what you choose when it comes to your home loan.

There are a lot of options out there and, with regularly moving interest rates and new products, it’s an ever-changing market. And let’s not forget that if you’re a first homebuyer, you’re probably very new to this.

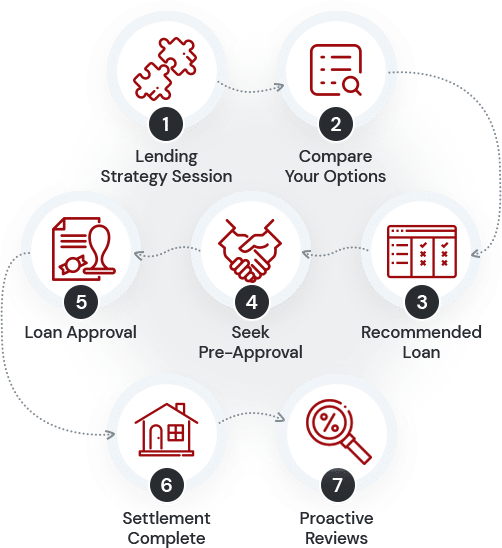

That’s why a broker makes sense. We do this everyday. We know the lenders, their products and policies and we keep up-to-date with changes. We help choose what’s right for you.

While banks merely promote their own financial products (whether they are the best for you or not), we are 100% independent and compare hundreds of loans from more than 40 lenders to get you the very best loan (rates, fees and conditions). Plus, we help you through the whole process to make getting your new home easy.