Guarantor Loans Explained

Struggling to save for a deposit on your dream home? Guarantor loans could be the solution you’ve been looking for. In this guide, we’ll explore the concept of guarantor loans, how they work, and why they’re a viable option for home buyers with limited savings.

Whether you’re a first-time buyer or looking to upgrade your current living situation, understanding guarantor loans can help you take the next step towards homeownership.

What Are Guarantor Loans?

Guarantor loans provide an opportunity for individuals with small or no deposits to enter the property market by leveraging the equity of a family member’s home. In essence, a guarantor – typically a parent or grandparent – agrees to use the equity in their property as security for the borrower’s loan. This added security allows borrowers to access higher loan amounts and favourable interest rates, even with a minimal deposit.

How Do Guarantor Loans Work?

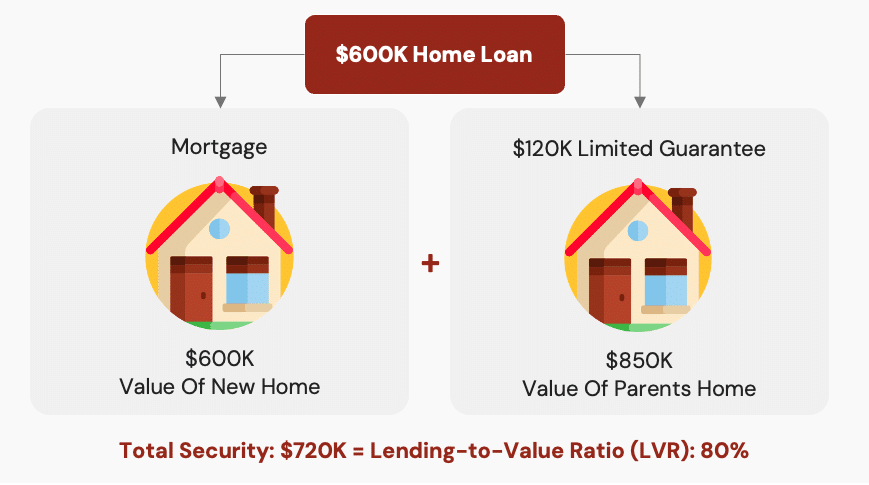

Let’s illustrate with an example: Suppose you’ve found your dream home priced at $600,000, but you only have a small deposit or none at all. With a guarantor loan, your parents could act as guarantors by providing a limited guarantee of, say, $120,000 secured against their home’s equity.

This effectively boosts your deposit to 20%, reducing the loan-to-value ratio (LVR) to 80%, which may qualify you for more competitive loan terms.

Releasing a Guarantor

One of the key benefits of guarantor loans is the ability to release the guarantor once certain conditions are met. Typically, this occurs when the guaranteed portion of the loan is paid off or the LVR drops below 80%. Releasing the guarantor not only removes their financial liability but also provides peace of mind for both the borrower and the guarantor.

Understanding Guarantor Responsibilities

While guarantor loans offer numerous benefits, it’s essential to understand the responsibilities involved. The guarantor is not a co-applicant on the loan but acts as a security provider. However, they become liable for repayments if the borrower defaults on the loan.

In extreme cases, failure to meet repayments could result in the guarantor having to sell their own property to cover the outstanding debt. Therefore, it’s crucial for guarantors to fully comprehend the risks and implications before agreeing to act as guarantors.

Conclusion

Guarantor loans provide a viable pathway to homeownership for individuals who may otherwise struggle to save for a deposit. By leveraging the equity of a family member’s property, borrowers can access higher loan amounts and favourable interest rates, paving the way for their property ownership dreams to become a reality.

However, it’s essential for both borrowers and guarantors to fully understand the terms, responsibilities, and risks associated with guarantor loans before proceeding. With the guidance of experienced mortgage brokers, borrowers can navigate the complexities of guarantor loans and make informed decisions that align with their long-term financial goals.