So, Interest Rates Are Dropping… Now What?

If you’ve been juggling mortgage repayments and thinking about your next financial move, you’re not alone.

The big question on many Geelong homeowners’ minds: What happens when rates start coming down?

Do you refinance? Borrow more? Invest? Or do you stay the course?

Let’s break it down, step by step, so you can get ahead of the curve before the market shifts.

Why Interest Rate Drops Matter

Interest rates don’t just determine how much you pay the bank each month, they shape the entire property market. Lower rates mean:

- Cheaper borrowing → Your repayments shrink, giving you more cash flow.

- Higher borrowing power → Lenders may let you borrow more, increasing competition.

- Stronger property prices → With more buyers in the market, home values can rise.

- Better refinancing deals → You might be able to negotiate a lower rate or restructure debt.

Sounds good, right? But knowing when to act is what really makes the difference.

What Should We Expect?

Now that rates have begun to come down, history shows more cuts will follow. Rate drops tend to happen in cycles, meaning borrowers who plan ahead can lock in better deals, pay down debt faster, or position themselves for investment opportunities.

So, how do you take advantage?

Step 1: Keep Paying Your Loan as If Rates Are Still High

Let’s say your mortgage rate drops from 6% to 5%.

Your repayments decrease, freeing up cash flow. But instead of spending that extra money, you keep paying your mortgage as if rates never dropped.

Here’s what happens:

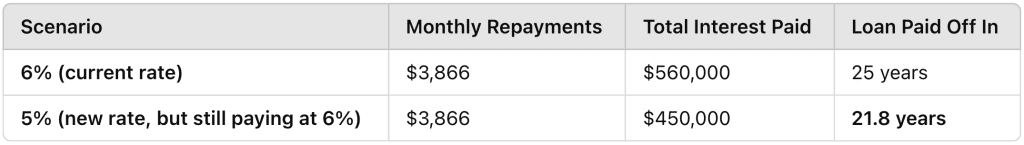

Example: $600,000 Mortgage (25-Year Term)

By keeping repayments at 6%, you slash years off your loan and save over $100,000 in interest.

This is a simple yet powerful strategy.

Step 2: How Rate Drops Impact Your Borrowing Power

Lower rates can increase how much you can borrow, but that doesn’t always mean you should.

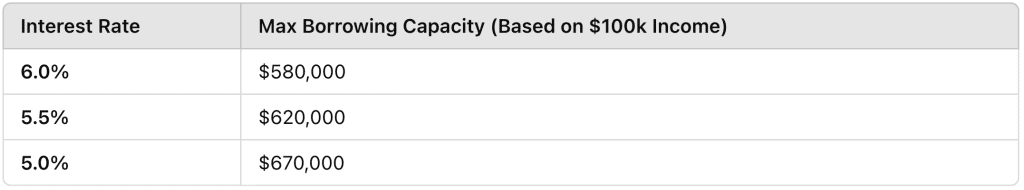

Example: Borrowing Power with Rate Cuts

Banks reassess serviceability as rates fall, which can give you access to more funds. But borrowing more just because you can isn’t always the right move. It’s smarter to use the opportunity to refinance, reduce your LVR, or secure better loan terms.

Step 3: Rate Drops and Your Equity Position

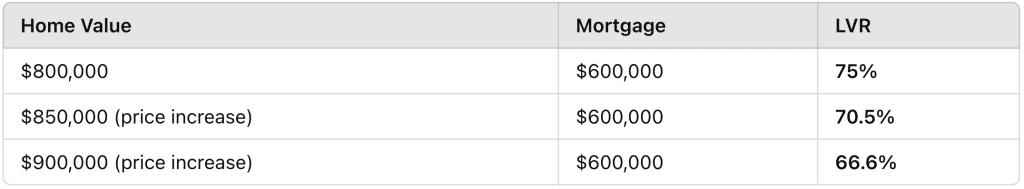

Your Loan-to-Value Ratio (LVR) is the percentage of your property’s value that you owe the bank.

When rates fall and property prices rise, your LVR naturally improves, even if you don’t pay a cent extra.

Example: How Lower Rates Impact LVR

Why does this matter?

- A lower LVR means lower risk in the eyes of banks.

- It can unlock better refinance rates.

- If your LVR drops below 80%, you may be able to remove Lenders Mortgage Insurance (LMI).

This is why some homeowners hold off on refinancing until rates fall and equity rises, to get a better deal.

Step 4: Should You Refinance When Rates Drop?

Refinancing isn’t just about chasing the lowest rate. It’s about resetting your loan strategy.

Here’s when refinancing makes sense:

- You want to lock in a better rate before further market changes.

- You want to consolidate debt or restructure your loan for flexibility.

- Your equity has increased, allowing you to negotiate better terms.

- You want to access funds for investing, renovations or another property.

But timing is key. If lenders expect more rate cuts, fixed-rate loans may stay high for longer than variable rates. Running the numbers is critical.

Step 5: The Investment Play – What Savvy Borrowers Do

If rates are set to drop, some investors act before it happens.

They might:

- Refinance now to secure equity and prepare for the next purchase.

- Use lower repayments to funnel more money into investments.

- Take out an investment loan while rates are low and property values are rising.

And for those who already own property, a strategic debt recycling approach could amplify the benefits of falling rates.

A Note on “Timing the Market”

One of the biggest questions people ask when considering their mortgage strategy is: Is now the right time?

Trying to predict the perfect moment to refinance, buy, or invest can be risky. History shows that long-term trends matter more than short-term fluctuations.

Australian home loan interest rates and median house prices tend to move in opposite directions.

Sitting on the sidelines waiting for a lower rate can be a false economy. The benefit of lower interest rates is often quickly absorbed by rising property prices. When rates drop, borrowing becomes cheaper, demand increases, and prices tend to surge, sometimes offsetting any advantage of waiting.

This is why it’s important to plan ahead. If you’re considering refinancing or investing, we can run the numbers across different scenarios to see how rate drops (and future rate cycles) could impact repayments, borrowing power, and property values.

The key isn’t just waiting for lower rates, it’s making sure you’re ready to act when opportunities arise.

How We’re Preparing You for the Rate-Drop Market

1. Keeping You in the Know

We track the product and rate decisions of 40+ lenders, constantly evaluating your situation against emerging product decisions.

You don’t need to spend hours keeping up with the RBA or lender forecasts – we do that for you. We’ll keep you informed about:

- When lenders are likely to cut rates

- How rate drops affect borrowing power and mortgage repayments

- Common misconceptions, like why waiting too long to refinance could cost you

When the market moves, we’ll make sure you are ready to act.

2. Reviewing Your Loan Structure

If you’re on a variable rate, we are assessing whether you’re in the best position to benefit from falling rates. If you’re on a fixed rate, we’re looking at when it expires and whether it makes sense to plan ahead.

We’re also helping clients with loan repayment strategies, like keeping repayments at the same level even as rates fall. This small move can cut years off a loan term and save thousands in interest.

3. Securing the Best Rate for You

When rates fall, banks sharpen their focus on new customers, often offering better deals to attract borrowers while leaving existing clients on higher rates. This is known as the “lazy tax,” and we make sure you’re not paying it.

There are two ways we help clients get a better deal: repricing and refinancing.

Option 1: Repricing with Your Current Lender

Before considering a refinance, we always try to negotiate a lower rate with your existing lender.

Why?

- No paperwork or fees

- No need to set up new accounts

- No impact on your credit file

Most banks won’t proactively lower your rate, but they will often match competitors if you ask. We have a dedicated repricing team that regularly negotiates on behalf of clients, often without you even knowing.

Option 2: Refinancing if a Better Deal is Available

If your lender isn’t offering a competitive rate, we look at refinancing options.

Refinancing can mean:

- Lower repayments and long-term interest savings

- Accessing cashback offers or switching incentives

- Moving to a more flexible loan product

But it’s not just about a lower rate. We go through the fine print, including exit fees and setup costs, to make sure refinancing actually saves you money.

4. Helping You Make Smart Moves with Equity

Lower rates can increase borrowing power. If you’ve been thinking about renovations, investing or consolidating debt, now could be the time to explore options.

We’re helping clients to:

- Understand how lower rates can improve their Loan-to-Value Ratio (LVR)

- Structure loans properly to avoid unnecessary costs

- Unlock equity for investment or home improvements without overextending

Even if you’re not looking to borrow, improving your LVR can give you access to better loan terms, reducing fees like Lenders Mortgage Insurance (LMI).

5. Supporting Property Investors in a Changing Market

Falling interest rates typically drive stronger property demand. That means opportunities, but also increased competition.

We help investors:

- Stress-test loans to ensure they remain affordable when rates eventually rise again

- Understand how rate cuts affect rental yields and tax benefits

- Assess the best way to structure investment loans, including strategies like debt recycling

With rate cuts expected to drive price growth, early action can mean getting in before competition heats up.

6. Guiding First-Home Buyers on Strategy

A common mistake first-home buyers make is waiting too long, thinking they need to time the market perfectly. But the reality is, rising demand could push prices higher before rates bottom out.

We help first-home buyers:

- Lock in pre-approvals early to secure borrowing power before demand surges

- Understand how lower rates affect LMI costs and first-home buyer grants

- Make informed decisions based on their long-term goals, not just short-term market trends

Final Thoughts: What’s Your Move?

Interest rate cuts create opportunities, but only for those who plan ahead.

- If you want to own your home sooner, keep repayments high.

- If you want to refinance, track your LVR and market shifts.

- If you want to invest, consider how borrowing power changes before prices move.

Whatever your next move is, now is the time to start thinking about it, before the market moves first. We are working behind the scenes to make sure you’re in the best position to take advantage of the changing market.

If you have any questions or if new goals or ideas have emerged, schedule a free lending strategy session. We can run the numbers on different scenarios to see how rate drops and future rate cycles could impact your repayments. Whether it’s repricing, refinancing or making smart moves with equity, schedule a chat to make sure your loan is working for you.