As the market and your circumstances change, the home loan that was just right for you then, may no longer be one that

suits you now. You may be looking to save a bit of money, consolidating your debt or looking to unlock some equity you’ve

built up in your home. Whatever the reasons, it’s a good idea to see what’s out there on a regular basis. But you should also

bear in mind the long term costs of increasing your borrowings.

Aussiewide Financial Services Geelong

Your Local Geelong Mortgage Broker

As Rates Change, A Better Loan or Lender Could Save You Thousands

With interest rates starting to shift, many homeowners are reassessing their mortgage options.

If you haven’t reviewed your loan in a while, now could be the time to check if you’re still on a competitive rate with the right structure for your needs.

Learn more about refinancing strategies in today’s market.

In some cases, a simple repricing (negotiating a better rate with your current lender) may be all you need. In others, refinancing to a new lender could offer more savings or better loan features.

Comparing all the options can feel overwhelming, but you don’t have to do it alone. We help homeowners assess their choices, so they can make an informed decision with confidence.

Refinancing isn’t just about chasing a lower rate. It’s about getting your home loan working for you.

- Reduce your repayments as rates come down.

- Pay off your loan sooner by keeping repayments steady.

- Consolidate debt or access equity for other financial goals.

A quick loan review can help you see the numbers clearly and determine if there’s a better way forward.

Free Refinancing Strategy Session

How We Help You Find the Right Loan (Not Just a Lower Rate)

For over 25 years, Aussiewide has helped more than 2,183 Geelong homeowners secure smarter home loans that save them money and support their financial goals.

Unlike banks that only offer their own products, we compare your loan against hundreds of options from over 40 lenders (including more favourable terms that your existing lender might be offering *new* customers). Whether you’re looking for lower repayments, better loan features, or a structure that works for the long term, we help you find the right fit, not just the lowest rate.

And while other brokers may be able to get you a new loan, we help you optimise your loans and structure your finances to also save interest, fees and even tax, so you have more money to enjoy now and invest for your future.

Check out our Guide To Refinancing for more information.

Refinancing, Made Simple for Geelong Property Owners

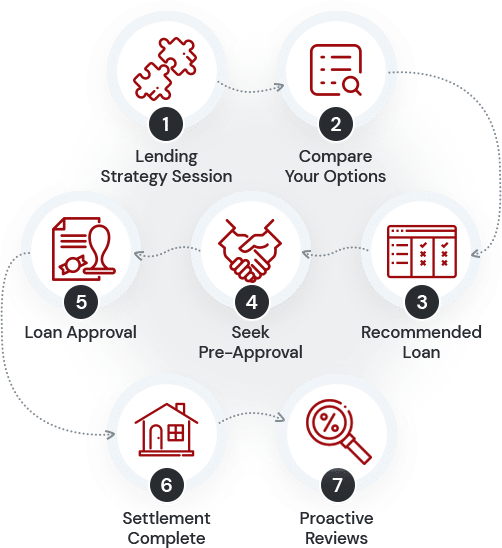

We make refinancing simple by handling the hard parts for you.

- We compare hundreds of loans from 40+ lenders to find the best fit.

- We handle the paperwork, saving you time and hassle.

- We provide ongoing loan reviews, ensuring your mortgage stays competitive.

- With 25+ years of experience in Geelong, we know how to structure loans to help you save and plan for the future.

And because we’ve been in Geelong for more than 25 years (go Cats!),

we have the experience and team to help you optimise your loans for maximum savings.

The Next Step To Make Sure You’re

Not Overpaying on Your Loan

(and Refinancing for a Better Deal)

Not sure if refinancing makes sense for you? In a free strategy session, we’ll review rate changes, potential savings, and whether restructuring your loan could put you in a better position. No pressure, just clear, expert guidance.

- Get an accurate picture of the loans available in the current market (and how much you may be able to save)

- Get more clarity around how much difference a small interest rate, fee and tax saving can make over the life of your loan (Hint: It’s often tens of thousands of dollars)

- Explore ways to structure your finances to legally redirect tax to pay your loan off years sooner or invest for even greater returns

- Learn about how our unique process helps you save thousands in interest, fees and tax, so you can free up thousands of dollars to enjoy now and invest for your future

Please be assured this session will not be a thinly disguised sales presentation. On the contrary, you will receive specific information and ideas to help you refinance and optimise your loans for maximum savings.

If you like our ideas, we can even do most of the paperwork for you! Or you can take the valuable information we provide and implement everything yourself. Either way, you have nothing to lose.