Refinancing vs Repricing: What’s the Difference, and Which Is Right for You?

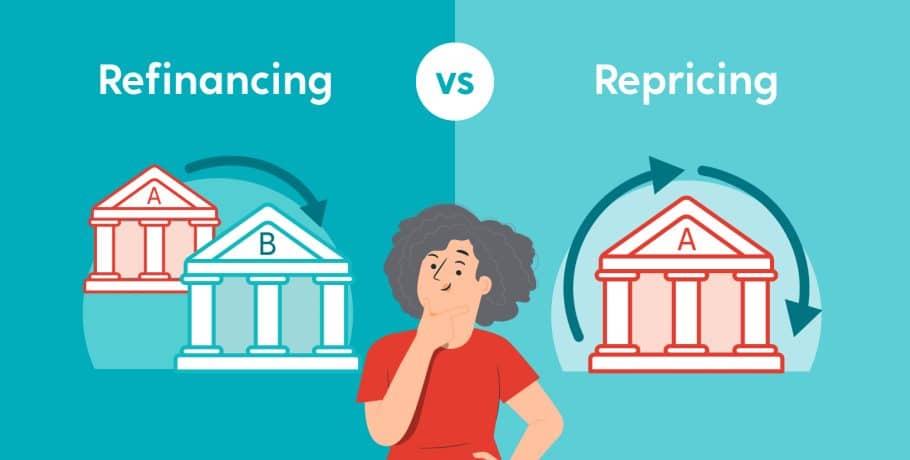

If you’re trying to lower your home loan repayments, two terms often come up: refinancing and repricing.

They both aim to save you money, but they do it in different ways.

This article breaks down how they work, when to use them, and how to choose the right strategy based on your goals.

What Is Repricing?

Repricing is when you ask your current lender to reduce the interest rate on your existing home loan. You’re not changing banks or getting a new product. You’re just asking for a better deal on the loan you already have.

This can often be done by calling your lender or using their online request form. If approved, your rate drops and everything else stays the same. You keep the same loan account, features and repayment schedule.

It’s a quick, simple way to reduce your repayments without going through a full application process.

When Repricing Makes Sense

Repricing is a smart first move if:

- You’re happy with your current lender

- You want a better interest rate without changing your loan

- You’ve noticed your lender offering better deals to new customers

It’s often as easy as saying, “I’ve seen lower rates from other banks. Can you match it?”

Many banks have retention teams set up for this exact conversation. If you have a good track record and strong equity, you may get a discount with minimal effort.

What Are the Drawbacks of Repricing?

The main limitation is that you’re still dealing with one lender. Even if they lower your rate, it may not be the best deal available in the wider market.

You also can’t use repricing to change loan features. So if you want to add an offset account, redraw facility or switch from a basic loan to a package, you’ll need to refinance.

Some lenders may not offer much flexibility. And if your loan is older or outside current promotional ranges, your options could be limited.

What Is Refinancing?

Refinancing is when you replace your existing home loan with a new one. You can refinance with a different lender or move to a different product within the same bank.

This process involves submitting a new application, providing documents, and usually getting a new property valuation. You’re starting fresh with a new loan contract.

It’s a more involved process but offers greater flexibility and choice.

When Refinancing Is the Right Option

Refinancing can make sense when:

- Your current lender won’t lower your rate

- You want to access equity for renovations or investment

- You want to switch loan types or features

- You’re consolidating debts into your home loan

- You’re trying to avoid ongoing fees or a package that no longer suits you

Refinancing gives you the freedom to compare lenders and find the loan that fits your financial goals, not just one that slightly improves on what you already have.

What Are the Downsides of Refinancing?

Refinancing takes more time and paperwork. You’ll need to:

- Submit a new application

- Provide income and identity documents

- Pay discharge and government registration fees

- Possibly pay new loan setup or valuation fees

Some of these costs can add up to a few hundred dollars. And if you’re on a fixed rate, break fees might apply.

You also need to be careful about extending your loan term unintentionally. Many people refinance into a new 30-year loan without realising they’ll pay more interest over time unless they increase their repayments or shorten the term.

How to Choose Between Repricing and Refinancing

If your main goal is to get a better interest rate with minimal hassle, try repricing first. It costs nothing to ask and you might get a better rate in a day or two.

If repricing doesn’t get you the result you want, or if you’re looking for better features or long-term flexibility, refinancing might be the smarter choice.

Always compare the total cost of each option, including fees and the potential interest savings over time.

Final Thought

Both repricing and refinancing can help you pay less on your home loan. Repricing is faster and easier, but more limited. Refinancing opens up more options and bigger savings, but takes more time and effort.

If you’re not sure which is right for you, a good mortgage broker can help you assess both. Start by reviewing your current rate. If it’s not competitive, you have options.

Taking action is what matters most—whether that’s a quick repricing or a full refinance that sets you up for the long term.